Property Taxes

Pay Taxes Online

You may pay taxes through our payment website by name, address, or the 10-digit parcel number listed on tax statements. You can find more information about each parcel on the Beacon Schneider website.

Pay your property taxes online with an eCheck for only .25 cents (which is less than a postage stamp) or you can pay with a debit or credit card for 2.25% of the total amount due.

Payment Methods

- In office with cash, check or debit/credit card (cards accepted for an additional 2.25% fee),

- Dropbox (located at the west entrance of the courthouse)

- Mail (must be postmarked by the end of the month to avoid 1.5% penalty)

- By phone (credit card payment only for an additional fee of 2.25%)

Pay your property taxes online with an eCheck for only .25 cents (which is less than a postage stamp!) or you can pay with a debit or credit card for 2.25% of the total amount due.

Accepted Credit Cards: MasterCard / Visa / Discover

Due Dates

- Property taxes may be paid in full in September each year or split into two installments:

- The first half is due September 1 and becomes delinquent October 1;

- The second half is due March 1 of the following year and becomes delinquent April 1;

Delinquent interest accrues at the rate of 1.5% per month, rounded to the nearest dollar with a minimum penalty due of one dollar.

Partial & Scheduled Payments

Benton County allows partial payments of property taxes of current property taxes. By law, you cannot make a partial payment on a tax sale or special assessment. If, at any time, you want to pay towards your property taxes, we will accept any amount of partial payment.

You can make partial payments directly to our office. Or, if you prefer, you are able to schedule automatic payments from your bank account either by e-check or card. The scheduled payments will be handled through https://www.iowatreasurers.org/index.php?module=scheduled by creating an account and setting up the schedule. To do this, you will need to follow these steps:

1) Add the property or properties you want to pay on the automatic schedule,

2) Set up payment account or enter your banking information,

3) Set up schedule. You can set up the schedule to pay monthly, weekly, bi-weekly or on a set date.

Here, you can also click "auto amount" or choose to pay a set amount each month.

By selecting the auto amount, the system automatically calcluates the number of payments you've selected and the amount needed by the due date (September 30 and/or March 30) and then will automatically pull that amount.

If you choose to pay a set dollar amount each month, you need to be aware that the amount chosen may not cover the full amount of property taxes by the due date. If this happens, you could incur late fees and/or additional interest.

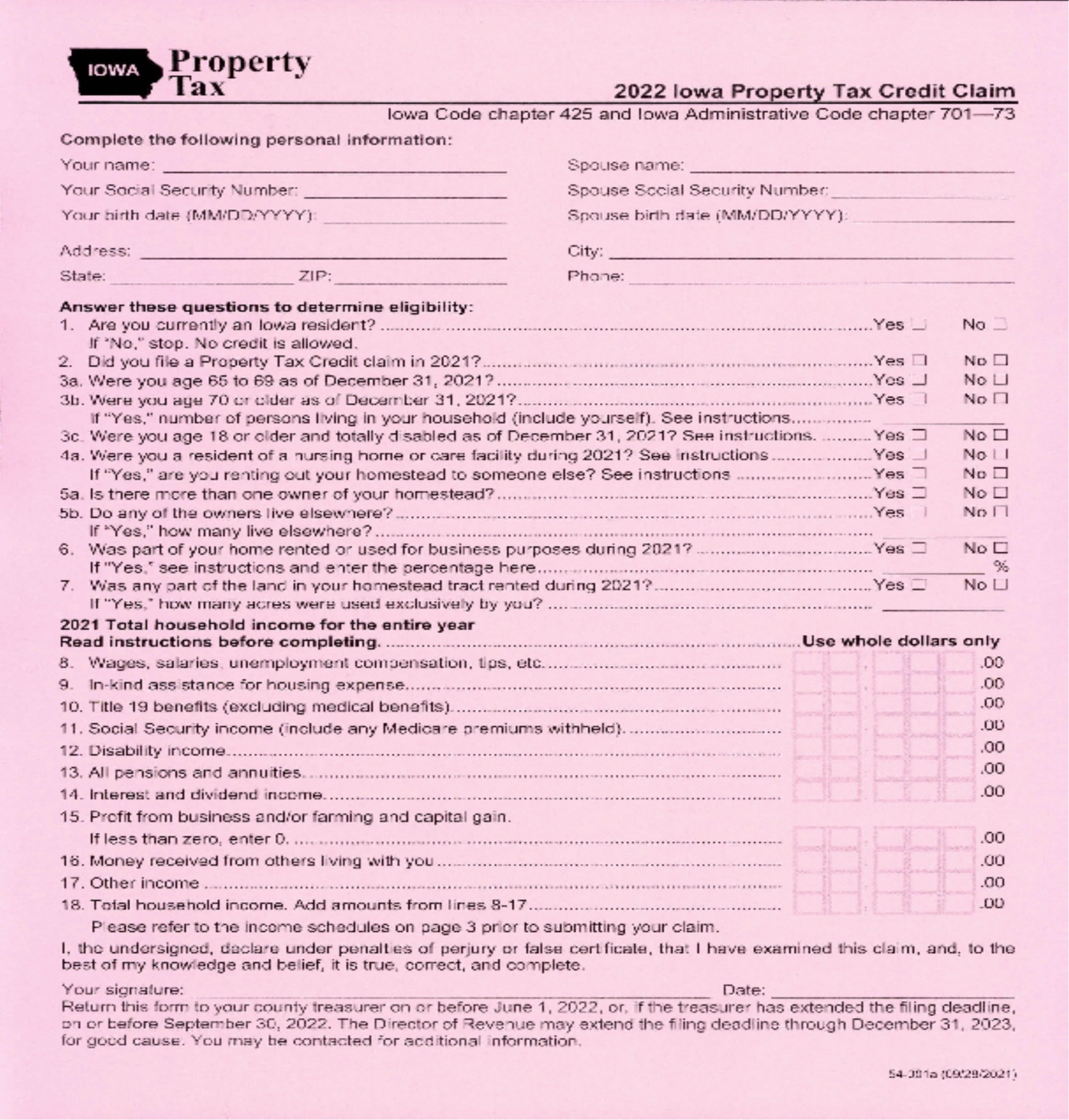

Property Tax Credits

- Elderly and Disabled Tax Credit:

*** IMPORTANT: Claimants of the elderly and disabled credit MUST file a claim EACH year in order to receive the (maximum) benefit of the tax credit. ***

- The Iowa legislature allows a property tax credit based on total household income for residents of Iowa, aged 65 and older, or age 18 and older, and totally disabled.

- Total household income for 2024 must be less than $26,219.

- The income requirements change annually. Claimants can receive a maximum credit of $1000.

- To file for this credit, complete and return this form to the office: 2025 Iowa Property Tax Credit Claim It must be returned to the office before June 1st.

Those age 70 or older, with high household income, now qualify for the property tax credit or "freeze" in 2022 and subsequent years. The first year applied for will act as the base amount for the property tax freeze. Below are the qualification guidelines:

250% Federal Poverty Level Table

| Number of persons in family/household | Total household Income |

| 1 | $37,650.00 |

| 2 | $51,100.00 |

| 3 | $64,550.00 |

| 4 | $78,000.00 |

| 5 | $91,450.00 |

| 6 | $104,900.00 |

| 7 | $118,350.00 |

| 8 | $131,800.00 |

For families/households with more than 8 persons, add $13,450 for each additional person.

- Mobile /Manufactured Home Reduced Tax Rate:

- The Iowa legislature allowes a property tax credit based on total household income for residents of Iowa, aged 23 and older, or age 18 and older and totally disabled. Iowa Resident as of December 31, 2024.

- Total 2024 household income was less than $26,219.

- Rented the property during any part of 2024.

- 2025 Iowa Mobile/Manufactured/Modular Home Owner Tax Credit

- Military Exemptions, Homestead Credits, and Tax Abatements:

- Military exemptions, homestead credits, and tax abatements are administered by the Benton County Assessor's Office. Contact the Assessor's page or office for further assistance.

Estimation of New Taxes

Do you have new construction in Benton County and would like an idea of what your property taxes will be? Beacon offers a new Property Tax Estimator on their website that can help determine taxes due on a new build or valuation fluctuations on current property in any tax district in Benton County. This is a great resource for realtors, closing companies, and mortgage partners.

* Important Note: The estimate given is based on current levies/and rollbacks. The actual amount due on future tax statements will be calculated based on the certified levies/rollbacks in place at that time.

Copies of Tax Statements

Please know that a copy of all Benton County real estate tax statements are available online through our Real Estate and Tax Inquiry page. There you can download a printable PDF statement. Paper statements are also mailed out annually in August to the homeowner.

Important Note: Property tax statements are mailed to the property owner only; NOT to escrow companies. Please note that we do not maintain escrow or property management records in most cases. If your taxes are paid by a third party, they are able to obtain your tax information online as noted above.

Notice of Delinquent Taxes

The law requires:

- A notice be sent to property owners who have outstanding taxes as of November 1 and May 1.

- A notice of the annual tax sale shall be mailed not later than May 1 to the person in whose name the parcel subject to sale is taxed

- Payments for redemption from tax sales must be paid by guaranteed funds. The rate of interest required by Iowa law to be paid on a redemption is 2% per month.

Delinquent taxes as of May 1 are assessed a publication fee and must be advertised for sale at the annual tax sale in June.

Office Hours

Monday - Friday

8:00 am to 4:30 pm Property Tax Payments

No appointment is required for property taxes.

*** Please note, the only public entrance is on the west side of the courthouse. ***